- July 22, 2024

- Posted by: Rachel DeLaune

- Categories: Blog, Hurricane Season

Flooding poses a significant risk to businesses in Louisiana, where heavy rains and hurricanes are common. Shockingly, nearly 40% of small businesses never reopen after experiencing a flood, according to the Federal Emergency Management Agency (FEMA). This is why protecting your business with commercial flood insurance is crucial.

1. What is Commercial Flood Insurance and why is it important?

Commercial flood insurance protects businesses from flood-related losses, including damage to property, equipment, and inventory. Standard property insurance typically does not cover flood damage, making this coverage essential. In Louisiana, where flooding is common, having this insurance can mean the difference between recovering quickly after a flood or facing severe financial hardships.

2. How does Commercial Flood Insurance differ from Standard Property Insurance?

Standard property insurance usually excludes damages related to flooding! This is because floods can cause extensive and widespread damage, making it too costly for standard property policies. Commercial flood insurance is a standalone policy that specifically covers flood-related damages, protecting your business against flood losses not covered by standard property insurance.

3. What does Commercial Flood Insurance cover?

A commercial flood insurance policy covers physical damage directly caused by a flood. For example, flood insurance will cover damage caused by water entering your building from the ground up due to heavy rainfall or the overflow of a body of water. However, flood insurance will not cover damage caused by a sewer backup, unless it’s a direct result of flooding.

- Building Property Coverage: includes the building and its interior, electrical and plumbing systems, HVAC equipment, and permanently installed fixtures like carpeting and paneling.

- Business Personal Property (Contents) Coverage: includes furniture, fixtures, machinery, and inventory.

Additionally, a flood insurance policy may cover certain expenses related to debris removal and the cost of measures taken to prevent flood damage. However, coverage can vary, so refer to your commercial flood insurance policy or contact your agent for an exact list of what is covered.

4. Who is required to have Commercial Flood Insurance?

Businesses with mortgages from federally regulated or insured lenders and located in a high-risk flood zone are required to have flood insurance. Businesses located in moderate or low-risk flood zones are not required by the government to have flood insurance, but it is strongly recommended. Additionally, private lenders may require flood insurance for properties in flood zones.

5. What flood zone is my business located in?

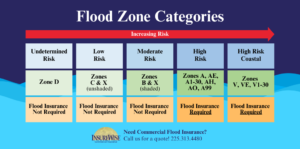

To determine your business’s flood zone, type your address into FEMA’s Flood Map Service Center. Your property can fall into one of these Flood Zone Categories:

- Undetermined: Zone D includes areas with possible flood hazards, but because no flood hazard analysis has been conducted to determine probability, the flood risk in these areas is undetermined. Insurance rates are based on the uncertainty of the flood risk. Flood insurance is recommended.

- Low Risk: Zones C & X (unshaded) are at a lower risk of flooding, though not entirely without risk. Flood insurance is recommended.

- Moderate Risk: Zones B & X (shaded) represent areas with a moderate risk of flooding. These areas may have reduced their risk with mitigation efforts such as levees or experience shallow flooding. Flood insurance is recommended.

- High Risk: Zones A, AE, A1-30, AH, AO and A99 are high-risk flood areas, due to proximity to a pond, stream, river or protective barrier under construction. Flood Insurance is mandatory.

- High Risk Coastal: Zones V, VE, and V1-30 are high-risk coastal areas with an additional hazard from storm waves. These areas have a 26% chance of flooding over the life of a 30-year mortgage. Flood insurance is mandatory.

6. Does Commercial Flood Insurance cover business interruption and loss of income?

Business Interruption and Loss of Income refers to the loss of revenue a business faces when it has to close or reduce operations because of flood damage. Standard commercial flood insurance does not cover this.

7. Can I wait and get Flood Insurance right before a storm?

No, you cannot wait until the last minute to get flood insurance. There is usually a 30-day waiting period before a flood insurance policy takes effect. Planning ahead and securing flood insurance well before the storm season begins is essential to ensure you have coverage when you need it most.

8. Can I purchase Commercial Flood Insurance directly from the Government?

No, you cannot purchase commercial flood insurance directly from government programs, like the National Flood Insurance Program (NFIP). Flood insurance can only be purchased through an insurance agency, like InsureWise. Our insurance agents can help you evaluate your flood risk, determine the appropriate coverage, and guide you through the process of obtaining commercial flood insurance.