- February 5, 2025

- Posted by: Danielle Chauncy

- Categories: Blog, Hurricane Season

The Rising Cost of Natural Disasters

Natural disasters are more costly and destructive than ever before. As a result, in 2024, the U.S. faced almost $200 billion in economic losses due to extreme weather events, shattering previous records. Businesses without proper business insurance were forced to close across the country, with some even shutting down permanently, due to catastrophic damage and financial setbacks.

A single disaster could wipe out years of hard work. This is why business owners must take action now to protect their assets, operations, and financial future.

Key Findings on Natural Disasters in 2024

Total Losses and Trends

-

- Overall economic losses from natural disasters in 2024 reached $190 billion, with $108 billion being insured losses. To put this into perspective, these numbers are well above the 10- and 30-year U.S. averages.

- Insured losses averaged $94 billion over the past 10 years and $61 billion over the past 30 years, highlighting the extraordinary nature of 2024’s figures.

Secondary Perils

-

- Losses from secondary perils, including floods, wildfires, and severe thunderstorms, totaled $136 billion, with $67 billion insured.

- Notably, severe convective storms were a major driver of insured losses, devastating communities and businesses nationwide

Severe Convective Storms

-

- Severe thunderstorms caused $57 billion in economic losses and $41 billion in insured losses.

- Consequently, 2024 became the second-costliest year for severe storms, following the record-breaking year in 2023.

Major Hurricanes

-

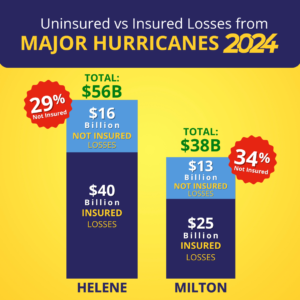

- Hurricanes Helene and Milton were among the most destructive storms of 2024.

- Helene resulted in $56 billion in overall losses, with $16 billion insured.

- Milton caused $38 billion in overall losses, with $25 billion insured.

Why Businesses Need Disaster Insurance Now More Than Ever

When disaster strikes, many businesses don’t survive the aftermath. Without adequate insurance:

- Property damage can drain company finances, ultimately forcing closures.

- Lost revenue from business interruptions can cripple cash flow.

- Rebuilding costs without insurance can take months—or years.

- Employee layoffs & supply chain disruptions can lead to permanent shutdowns.

The right business insurance ensures faster recovery, financial security, and continued operations—even after a catastrophic event.

How InsureWise Can Help Your Business Stay Protected

At InsureWise, we understand the devastating impact natural disasters can have on businesses. We give tailored insurance solutions designed to protect your assets and ensure a swift recovery.

Here’s what we can offer:

- Customized Coverage: Comprehensive policies to protect against secondary perils and unique risks, including floods and severe storms.

- Risk Management Expertise: We work closely with clients to identify potential vulnerabilities and implement strategies to minimize risks before disaster strikes.

- Responsive Claims Handling: A dedicated team to ensure a smooth, efficient recovery process.

- Business Continuity Support: Resources and guidance to help you maintain operations and recover effectively after a loss.

Preparing for the unexpected is more important than ever. Don’t let the next disaster put your business at risk!