- February 21, 2024

- Posted by: Rachel DeLaune

- Category: Uncategorized

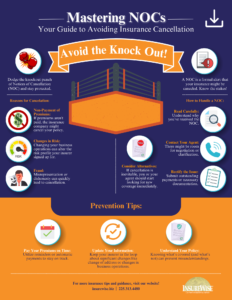

Notices of Cancelation (NOCs)

In the ring of life, unexpected punches can come from anywhere, and one such surprise blow can be a Notice of Cancellation (NOC) from your insurance company. Like a seasoned boxer dodging a knockout punch, it’s crucial to master the art of handling NOCs to ensure you’re not left unprotected. In this article, we’re unpacking everything you need to know about NOCs and how to effectively deal with them.

Understanding Notices of Cancelation (NOCs)

A Notice of Cancellation isn’t just a courtesy call; it’s a formal document signaling that your insurance coverage is on the brink of being canceled. This isn’t about fear-mongering; it’s about understanding the gravity of such notices and the impact they can have on your coverage. Imagine, for a moment, the security blanket of your insurance being pulled away when you might need it the most. That’s what’s at stake with a NOC.

Reasons for Cancellation

The reasons behind receiving a NOC can vary, but they often boil down to a few common issues:

1. Non-payment of Premiums: This is straightforward. If you’re not keeping up with your premiums, your insurance provider might show you the door.

2. Changes in Risk: Changing your business operations can alter the risk profile your insurer signed up for.

3. Fraud: This is a deal-breaker. Misrepresentation or dishonesty can quickly lead to cancellation.

Understanding these reasons is the first step in preventing a NOC from landing in your mailbox.

How to Handle a Notice of Cancellation (NOC)

Receiving a NOC can feel like a low blow, but it’s not the end of the round. Here’s how to bounce back:

1. Read Carefully: Understand why you’ve received the NOC.

2. Contact Your Insurance Agent: There might be room for negotiation or clarification.

3. Rectify the Issue: Whether it’s outstanding payments or necessary documentation, act swiftly.

4. Consider Alternatives: If cancellation is inevitable, you or your agent should start looking for new coverage immediately.

Time is critical when dealing with a NOC, so don’t procrastinate.

Prevention Tips

As the saying goes, “An ounce of prevention is worth a pound of cure.” Here are some tips to avoid the stress of dealing with a NOC:

1.Pay Your Premiums on Time: Utilize reminders or automatic payments to stay on track.

2. Update Your Information: Keep your insurer in the loop about significant changes like change of address or changes in business operations.

3. Understand Your Policy: Knowing what’s covered (and what’s not) can prevent misunderstandings.

Staying proactive and informed can shield you from the unexpected jabs of insurance cancellations.

Staying in the Ring

Understanding NOCs, the reasons behind them, and how to effectively handle them can make all the difference in maintaining your coverage and peace of mind. Remember, in the boxing ring of life, it’s not always about how hard you hit, but how well you can dodge the punches and stay standing.

Contact Us Now for expert guidance on managing your insurance needs and staying prepared for whatever comes your way. Let’s ensure you’re always covered, together.