- April 4, 2024

- Posted by: Rachel DeLaune

- Category: Uncategorized

This topic can be confusing, but it’s important to get it right: the distinction between W-2 employees, independent contractors, and subcontractors, especially in the construction industry.

W-2 Employees

Imagine you’re embarking on the journey of building a client’s dream home. At your side is your trusted team, your W-2 employees, the core crew you rely on daily. You direct their work – where to lay bricks or when to swing the hammer. As their employer, you’re in charge of their daily tasks, ensuring everything aligns with your standards. Since they’re officially part of your company, you need to protect them with Workers’ Compensation Insurance. If someone falls off a ladder while working, your Workers’ Compensation Policy steps in to cover medical expenses and 2/3rds lost wages (tax free). It’s a must-have to protect both your employees and your business.

Independent Contractors (Uninsured Subcontractors)

Now, let’s say you call in a specialist for the custom Italian marble work. This person is an independent contractor (also known as an uninsured subcontractor). They bring their own tools and direct their own work, calling the shots on their installation methods.

As the term “uninsured subcontractor” suggests, they do not have their own insurance. The hiring company is responsible for injuries on the job. So, they need to be added to the hiring company’s Workers’ Comp or General Liability insurance policy to ensure coverage in case of a claim.

If the uninsured subcontractor gets hurt or causes damage on the jobsite, those claims are covered by the hiring company’s Workers’ Comp or General Liability policy. Which is why coverage for these operations needs to be added to your policy before any work begins.

Subcontractors (Insured Subcontractors)

Let’s say you need an entire team to install the electrical in the house, but electrical work is not your area of expertise. So, you hire an electrical subcontractor to do the job.

This subcontractor operates as an independent company, complete with an LLC, tax ID and EIN number. They bring their own tools, direct their own work, and are usually paid per project.

Further, the subcontractor has their own insurance, which covers their team in case of accidents. It is very important that you verify their insurance before starting work.

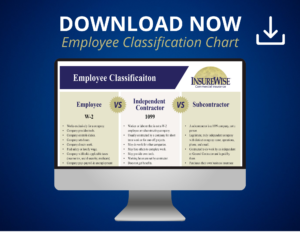

Employee Classification Chart

To help you further, we’ve created an “Employee Classification Chart,” detailing the characteristics of W-2 employees, independent contractors, and subcontractors. This chart is a valuable tool for quick reference, ensuring you classify your workforce correctly. Click here to download and keep this chart handy for your next project.

Liability and Taxes: Fitting the Pieces Together

W-2 Employees: You’re in charge of handling their taxes (called “withholdings”), Social Security, and everything else that comes with employing a traditional workforce. They are covered under your company’s insurance for any on-the-job accidents or damage.

Independent contractors (aka Uninsured Subcontractors): They handle their own taxes due to their 1099 tax designation. Since they do not have insurance, they need to be added to the hiring company’s Workers’ Comp and General Liability policies.

Subcontractors (aka Insured Subcontractors): They manage their taxes and insurance. However, before work begins, it’s important that you verify the subcontractor is correctly classified and their insurance covers the operations they’ll perform. This means that if you hire a roofer, you need to confirm that their Workers’ Comp and General Liability policies cover injuries and damage related to roofing operations. Additionally, your company needs a written and signed subcontractor agreement in place between you and the subcontractor that includes an indemnification clause in your company’s favor. All this means is if something goes wrong because of the sub’s work (like an accident or a legal issue) the sub will take responsibility and cover any costs or damages, leaving you and your company off the hook!

Check out this video for more information about Subcontractor Agreements and Indemnification.

A Cautionary Tale

Consider the scenario of Bob’s Construction. Bob hires Joe, a subcontractor, to come in and do the roofing work. Joe claims he has insurance, but Bob doesn’t verify this and doesn’t request a Certificate of Insurance (COI).

Mid-project, Joe falls off the roof and is injured. It turns out that Joe actually didn’t have insurance. So, Bob’s Workers’ Comp policy is forced to cover the medical bills and lost wages, leading to a significant increase in premiums for Bob.

On top of that, Bob did not get Joe to sign a subcontractor agreement, so Bob was on the hook for legal costs when Joe sued him for negligence.

This costly oversight could have been easily avoided if Bob had verified Joe’s insurance coverage and had a signed subcontractor agreement in place. Always verify insurance before letting any subcontractor start working! This will protect your business from unexpected liabilities.

Safeguarding Your Project

Navigating the classifications of W-2 employees, independent contractors, and subcontractors can be challenging, but it’s crucial for insuring your project against unforeseen events. If in doubt, always consult your insurance agent for guidance.